Additionally, we can substitute back into the first equation for volatility and rearrange to get: With this formula, we can use estimates of the covariance and overall portfolio variance to calculate the MCTR. This is more complicated than the weighted average of the standard deviations, and it is only a weighted average of the variances (weighted by the square of the asset weights) when all of the assets are uncorrelated.ĭifferentiating this formula with respect to w i yields: The volatility can be written using the asset covariances: However, with a little mathematical manipulation, we work this into a more intuitive form. Estimating derivatives such as MCTR can be tough when smoothness is not guaranteed. “Marginal” refers to the incremental risk introduced in the portfolio for a given change in asset allocation. The dependence of σ on a derivative of σ introduces nonlinearity when the assets are correlated. Which appears to be a nice, linear equation, as well, until we look into how we calculate MCTR: Where r i is the return on asset i and w i is the weight of asset i in the portfolio.įor portfolio risk attribution, one formula often seen utilizes the marginal contribution to risk (MCTR): That is, for n assets, the portfolio return, R, is given by: When we calculate the return of a portfolio, we can simply take the weighted average of the individual asset returns. Return attribution is a simple, linear calculation.

One asset can look very different when it is taken in the context of two different portfolios.

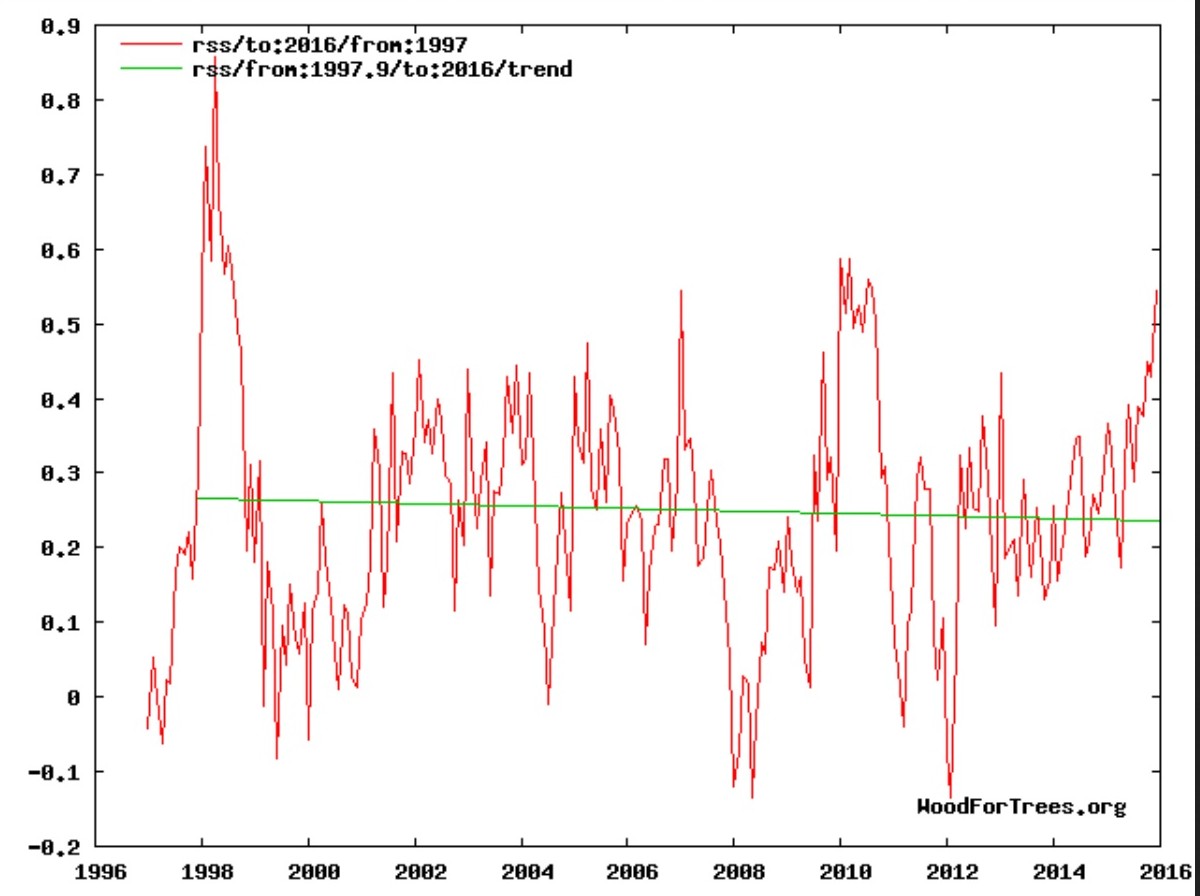

It is this complex interaction among the individual assets that makes risk attribution interesting when examining portfolios. Return characteristics aside, a well-diversified portfolio can be less risky than any of the constituents taken alone it is truly a case where the sum of the parts is greater than the whole.

#Tlt backcalculation free

Diversification is touted as the only free lunch (see our old post Is Diversification Really a Free Lunch) in investing and is a primary way to reduce portfolio volatility without sacrificing a proportional amount of return.

0 kommentar(er)

0 kommentar(er)